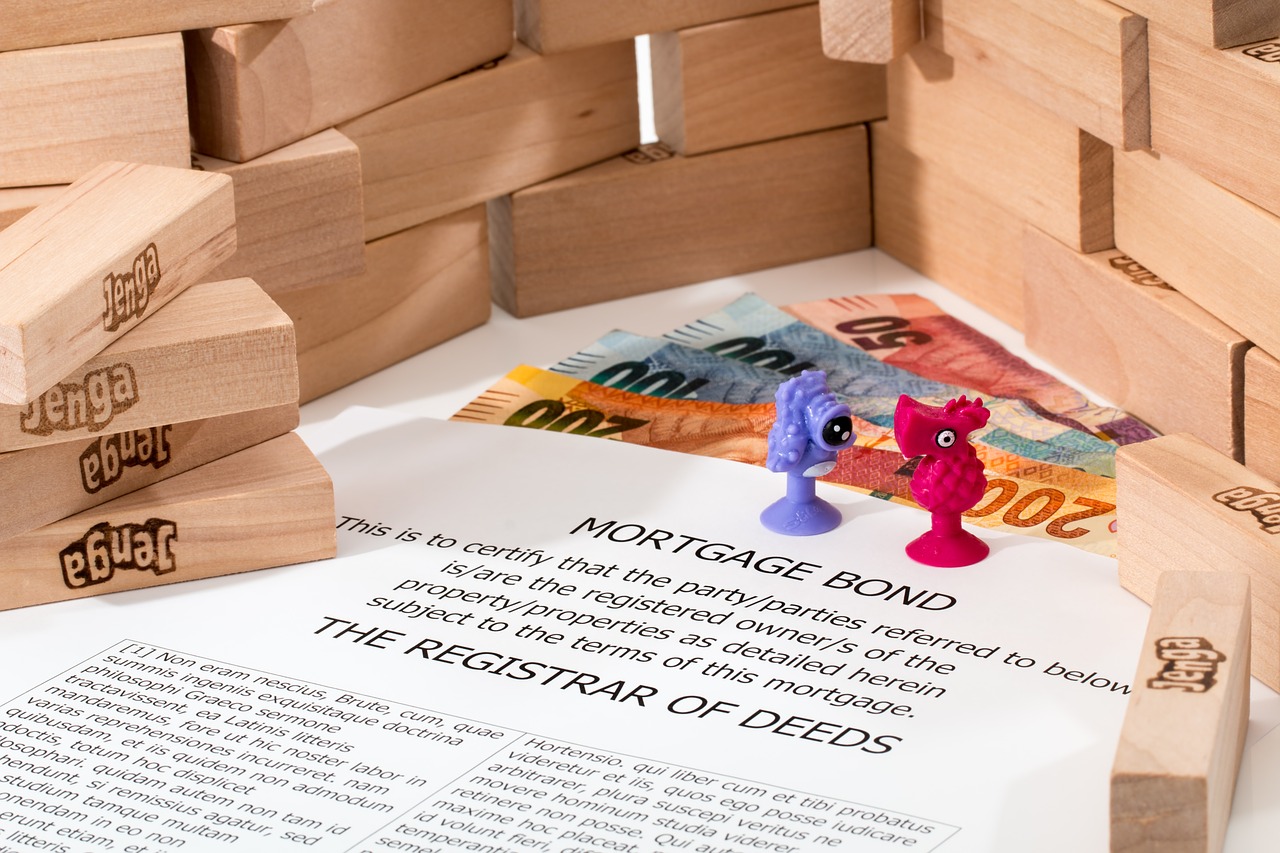

I had a client that went through a tough year financially and was several months behind on his mortgage payment. After doing a CMA we found that he was probably going to have to sell for less than what was owed. He did not have the resources to cover the difference so we immediately put together a short sale package and tried to submit it to the lender.

Unfortunately, the lender was unwilling to look at it until we were in escrow. We priced it to sell and got a good offer. We submitted the package and left a message for them to call us. After repeated attempts to contact the loan workout specialist with no success we managed to get an assistant on the phone that told us it would be a week before we heard something.

The week went by and we called, only to find out the person we were working with had quit and the person that was taking over would need at least an additional week to get to our request. A week later after numerous attempts had failed we contacted the department head explaining to her that the buyer was starting to look for other homes because of the lengthy delays.

The very next day I got a hold of the workout specialist who told me she couldn’t talk to me because she believed the signature on the authorization letter was forged and didn’t want to risk liability by disclosing confidential information. Even though I explained to her I had a copy of the client’s package, which included tax returns, bank statements and a loan application in front of me.

So I had to wait until my client got off work to have the letter re-executed. Even though we were close to getting the short sale approved, the lender chose to file a notice of default, which was going to further reduce the lenders net. We finally got the short sale approved but to my horror the lender was not going to allow a seller credit for buyers closing costs.

I was relentless in my attempts to speak to the specialist and hours later finally succeeded. I had to explain to her that this was a first time buyer that was getting 100 % financing and didn’t have $8,300 for closing costs and any credit less than that would reduce the buyers cash reserves which would certainly impact the buyers ability to qualify.

It just seemed that every time we made headway the lender would create another obstacle we had to overcome. Although the buyer threatened to cancel because of the delays we did manage to get this transaction closed, with a bad case of heartburn I might add.